Reality Store Teaches FHS Students about Life Expenses

(Crystal A. Proxmire, April 17, 2014)

Shock, awe and gratitude were among the responses by 11th graders at Ferndale High School as they tried to figure out a household budget at the school’s “Reality Store” on Thursday.

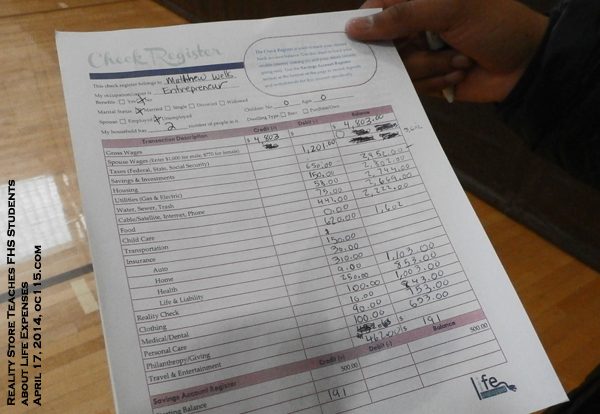

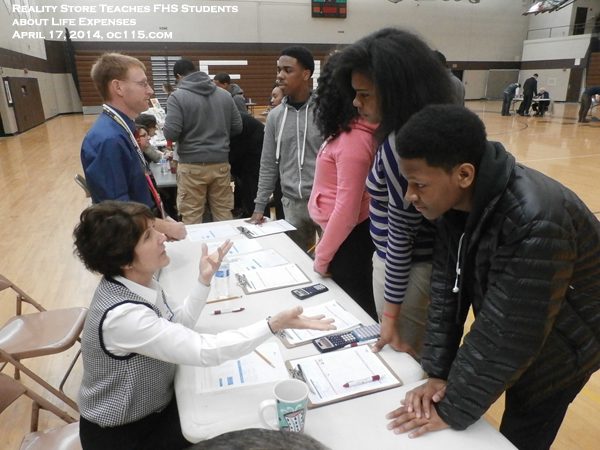

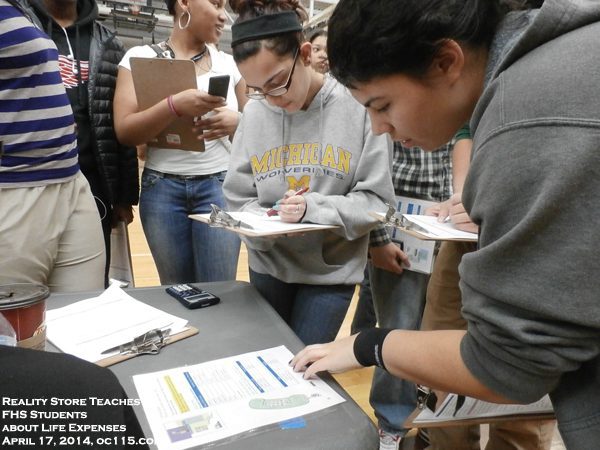

The teens picked out a career and a roll of the dice determined if they had a spouse or children. Business teacher Ms. Oliver found the average income of the students’ professions, and gave them a budget sheet to  work off of. Then the students went to various tables set up in the gym with volunteers to talk to them about their options for housing, transportation, child care, utilities, and other expenses.

work off of. Then the students went to various tables set up in the gym with volunteers to talk to them about their options for housing, transportation, child care, utilities, and other expenses.

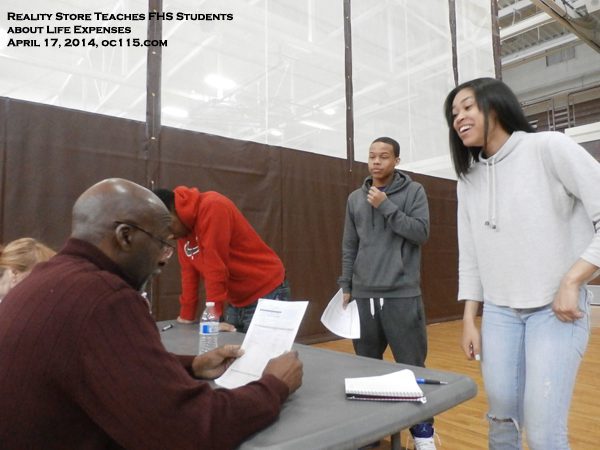

Justice and Matthew were among the students who got a taste of reality. Justice decided on a career in manufacturing management. “I like to be in charge,” she said. The decision brought her a monthly budget of $7,203, but being assigned four children made the expenses add up quickly.

Matthew decided to follow in his father’s footsteps and listed his profession as “entrepreneur.” Without the expense of children, Matthew had more flexibility in his choices, but his monthly income was set at $4,803.

Just like in real life, the incomes and family circumstances ranged. One student struggled with a $1,000 a  month budget as a video game animator, while the teen who picked orthodontist had ten times as much to work with.

month budget as a video game animator, while the teen who picked orthodontist had ten times as much to work with.

“It is a reality check for some of these students. It gives them a chance to think of if they want to have a certain lifestyle, will they have a career that supports that,” said Principal Lisa Williams. Ferndale Schools student begin thinking about their career path in middle school, creating an educational development plan that helps youth focus on their future, but is also flexible enough to grow as the student does. “This exercise is a positive way to shed light on what the future is like,” she said.

Housing was the biggest expense the teens faced. Ms. Minneci, a recently retired counselor who had been with the district for 40 years, volunteered to talk to the youth about what their options were. “Right now I’m old enough my house is paid for, so when I sell it I get all that money back. But when you rent, and you leave, you don’t get anything,” she said. “But when you rent sometimes utilities are included, and generally  the owner of the home will do the yard work and the maintenance. So if you aren’t very handy you may want to rent instead.” Although he did not have children, Matthew decided that one day he might want a family, so he opted to buy a three bedroom house at a cost of $650 per month.

the owner of the home will do the yard work and the maintenance. So if you aren’t very handy you may want to rent instead.” Although he did not have children, Matthew decided that one day he might want a family, so he opted to buy a three bedroom house at a cost of $650 per month.

Utility costs were a surprise to students, many of whom seemed to think that television and internet was free. Volunteers Jodi Knittel and School Board Trustee Amy Butters explained the different options for cable, phone, tv and internet service. When Justice said she could do without tv and internet, Knittel suggested that it might be hard having four children that needed to get online to do homework and email people to go without having online access.

Fellow School Board Trustee Nan Kerr-Mueller shocked the kids by showing them how much food costs.  “There is no shame in clipping coupons,” she said. “Some people can’t afford to shop at high end supermarkets, or buy all organic healthy food. It’s a tough choice that people on a budget have to make.”

“There is no shame in clipping coupons,” she said. “Some people can’t afford to shop at high end supermarkets, or buy all organic healthy food. It’s a tough choice that people on a budget have to make.”

After figuring out childcare, transportation and insurance expenses, the students reached Paulette Boggs’ table. That’s the place where the random life event happened. Each teen picked a number out of a basket to see what surprise life had in store for them. Justice was surprised with a $75 bill for piano lessons, while Matthew was obligated to deduct $250 for holiday presidents. Others had a $40 unplanned anniversary present to buy, a kids fundraiser for $15, or emergency car repairs. One young man won $75 in a lottery, while another was surprised with a new baby in their home and had to go all the way back to the beginning  to budget for his larger family. Most times the response was the same. “That is so unfair,” Matthew said. “I was all set without that.” And of course Bogg informed him that “you can’t always budget to the penny because things are always going to come up.”

to budget for his larger family. Most times the response was the same. “That is so unfair,” Matthew said. “I was all set without that.” And of course Bogg informed him that “you can’t always budget to the penny because things are always going to come up.”

By the time they reached the hygiene and travel tables, most students were close to zero. Each teen had a minimum of $10 in hygiene expenses, and $20 deducted for each child. Ms. Ward and Ms. Gostomski, who taught primary school in the district in years past, explained to the students that hygiene products are expensive even though they normally may not think of it. “Things like toothpaste, deodorant, and toilet paper add up,” Gostomski said.

By the end of the assignment, Justice still had $3,000 left to go into savings but Matthew had less than $200. Many of the students went all the way to $0, and some even dipped into the $500 savings account  they were given just for emergencies.

they were given just for emergencies.

“Next time you ask your parents for $20 you know why they can’t give it to you,” said parent volunteer Barb Landry. “This is such a good experience for them. We hear from kids that they want to go home and thank their parents.”

Matthew said the experience will make him work harder in school and be careful with his money. His father is a holistic health practitioner, has shown him the value of owning his own business. Matthew, who has a 3.0 GPA, said “I’m going to UCLA to major in technology and I’m going to invent something so that I can run my own company. I don’t want to work for anybody else. I learned that from my dad.”

For more information on Ferndale Schools visit www.ferndaleschools.org.